Claims & Service

Our Services

At Insurance Managers, we believe great service doesn’t stop after you purchase a policy. Whether you’re filing a claim or updating your coverage, our team is here to help—quickly, clearly, and with your best interest in mind.

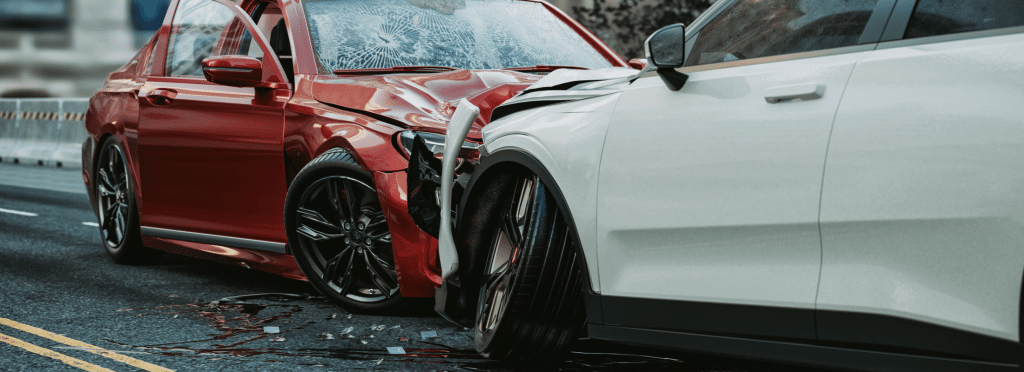

Tupelo Auto Insurance

Auto Insurance

The right auto insurance policy can help get you back on the road quickly if your car is damaged or destroyed by an accident, fire, theft, or other event covered by your insurance policy. Your policy may also provide protection against medical and legal expenses resulting from injury, loss of life, or property damage caused by an accident involving your vehicle.

An auto insurance policy is a contract between you and an insurance company. You pay a premium and in exchange, the insurance company promises to pay for specific car-related financial losses during the term of the policy. We can help you determine the best coverage for your needs.

How much auto insurance is right for you?

Our team of insurance professionals understands the Mississippi car insurance needs of our customers. Auto insurance requirements vary by state. In some states, to drive you must carry:

- Liability coverage to pay for losses you cause others

- We write insurance in Mississippi and would be happy to help you ensure you have the right car insurance coverage.

- Comprehensive Coverage

- Collision Coverage

- Uninsured Motorist Insurance

- Medical Payments

- Roadside Insurance

- Rental Car

Even in states where coverage isn’t required, by law drivers must be able to pay for losses they cause others. Having insurance is the simplest way for most people to comply. To finance a car, it is usually necessary to have insurance which covers damage to your vehicle. This includes:

Collision coverage pays for damage caused to your vehicle in an automobile accident. Standard collision coverage will pay for any repairs up to the fair market value of your car. Collision coverage usually also comes with an insurance deductible. It’s the amount of money you pay toward repairs before your collision insurance kicks in. The higher the deductible you’re willing to pay, the less the collision coverage will cost.

Comprehensive insurance covers damage done to your car in some way other than a collision, such as if it were stolen or vandalized. Flood, hurricane, theft, windshield damage and fire are also events usually covered by comprehensive car insurance. Like collision, comprehensive will pay up to the fair market value of your car (less your insurance deductible.) Although it’s not legally required by any state, you will probably need it if your car is financed.

Every person is unique – talk to us today to find out how to get the best price and value on Tupelo car insurance for you.

Tupelo Home Insurance

Home Insurance

Your home is likely your most valuable asset, and protecting it is essential. At Insurance Managers, we help homeowners, renters, condo owners, and landlords find tailored coverage that fits their needs and budget.

Whether you live in a house, apartment, or condo, the right policy can provide peace of mind and financial protection from events like fire, theft, vandalism, and more. It can also cover you if someone is injured on your property and files a legal claim.

We offer a variety of policies—from comprehensive coverage to more limited plans—so you can choose the protection that’s right for you. Our team is here to make the process simple, offering expert guidance and fair pricing every step of the way.

Your home insurance policy is most often made up of the specific options you choose. How much you’ll pay for your policy depends on:

- Options you select – Often home owner insurance options are priced individually, so how much you’ll pay for your policy depends on what coverages you buy.

- How much you want to cover – Higher deductibles usually lower your premium price by shifting part of the loss payment to you. For example, if you had a $500 deductible, you would be responsible for paying the first $500 of the covered loss.

- Where you set your limits – You may choose to set higher limits than the recommended amount if appropriate to your situation and needs.

The Right Coverage. The Right Price. The Right Value

The amount you pay for your home owners insurance depends on many factors. Think of your personal housing situation, and the assets you want to protect.

Property or Dwelling Coverage typically pays to repair or rebuild your home if it’s damaged or destroyed by an insured event like a kitchen fire or windstorm.

Personal Liability Coverage applies if someone is injured or their property is damaged and you are to blame. The coverage generally applies anywhere in the world. When choosing your liability coverage limits, consider things like how much money you make and the assets you own. Your personal liability coverage should be high enough to protect your assets if you are sued.

This covers medical expenses for guests if they are injured on your property, and in certain cases covers people who are injured off of your property. It does not cover health care costs for you or other members of your household.

If you can’t live in your home because of a covered loss, your home insurance policy will pay additional living expenses (commonly for up to 24 months) while damage is assessed and your home is repaired or rebuilt.

Your home is filled with furniture, clothes, electronics and other items that mean a lot to you. Personal Property Insurance helps replace these items if they are lost, stolen or destroyed as a result of a covered loss.

If you have special possessions such as jewelry, art, antiques or collectibles you may want to talk to your agent about this additional coverage. It provides broader coverage for specific items.

Protect the Things that Matter to You

Make an inventory of your home and personal belongings. If possible, make a list as well as take photos or video – using two inventory methods can help expedite the claim resolution process. Keep this list somewhere other than your home. Keep in mind that your policy doesn’t cover damages caused by poor or deferred maintenance on your part.

Every home is unique. Talk to us today to find out how to get the best price and value on Tupelo home insurance for you.

Tupelo Motorcycle & ATV Insurance

ATV & Motorcycle Insurance

If you live in Mississippi, chances are Insurance Managers covers what you ride. Insurance Managers insures a full spectrum of motorcycles from street cycles, Harley Davidsons, cruisers and touring bikes, to dirt bikes and ATVs.

You May Qualify for Discounts

One of the great advantages of having your motorcycle coverage through a major insurance company like the ones we represent, is that you may save money by having more than one policy with us. Our agency will be able to help calculate how much money you can save. You also may be able to save money on your premiums if your motorcycle is stored in a garage, if you belong to certain rider groups, or if you have taken a safe rider course sponsored by the Motorcycle Safety Foundation.

About Motorcycle Insurance

Your motorcycle insurance policy can include any or all of the options below. Call us today to discuss what coverage is best for you.

If you select custom parts coverage, you will receive up to $3,000 in coverage without any additional cost to you. Coverage is available for up to $10,000 in custom parts and equipment.

Your motorcycle insurance policy can provide you with a roadside assistance benefit of up to $300 per breakdown.

You can pick the motorcycle insurance coverage that fits your needs. Many insurance companies offer underlying liability limits high enough to satisfy Personal Umbrella requirements, which means that you may be eligible for this additional coverage. In most states, Guest Passenger liability (mandatory on all street bikes) is automatically included at the same limit as your liability selection. Insurance Managers works with multiple insurance companies so we can provide you with multiple motorcycle insurance coverage options at rates you can afford.

This coverage provides for certain necessary medical expenses for you and any passenger that are the result of an accident.

This coverage typically pays for expenses associated with injury or death from an accident caused by an uninsured, underinsured, or hit-and-run driver. It also covers you if you are hit as a pedestrian.

Tupelo Boat & Watercraft Insurance

Boat & Watercraft Insurance

Insurance Managers can help make your time on the water relaxed and worry-free. We will find you comprehensive protection that protects you, your friends and family, your watercraft and your boating equipment. The average boat costs less than a dollar a day to insure. You’ll enjoy being on the water even more when you aren’t worried about your safety, the safety of your passengers, or your investment.

Do you know what to look for in a Tupelo watercraft insurance policy? Insurance Managers can help you determine the right amount of coverage to meet your specific needs. Just contact us today to get started.

Here are some items you’ll need to consider when shopping for Tupelo boat insurance.

Know where you are covered in the water. Some insurance companies offer protection that covers you up to 75 miles from the U.S. coastline, into Canadian coastal or inland waters, and into the Pacific coastal waters of Mexico. In California, Florida and Oregon, coverage for additional areas can be purchased.

Watercrafts depreciate just like cars. Actual cash value policies can make it difficult to replace a boat that has been stolen or destroyed. This means that if your boat is a total loss you will get the value you insured it for, minus any deductible.

Like car insurance, personal liability coverage provides coverage to other boaters and boat owners in the event you are at-fault for an accident on the water. This coverage will pay to repair or replace the property of someone else as well as for their medical care, lost wages, and other costs incurred as a result of a boating accident for which you are at-fault.

Medical payments coverage will pay for the cost of needed care that is the result of a boating accident. This coverage is available from $500 to $10,000 and covers you, your passengers, and even your water skiers/tubers, regardless of who is at-fault.

Physical damage coverage pays for the cost to repair or replace your watercraft, its motor, any permanently attached equipment, and your trailer if it is stolen or damaged.

Since boat insurance is not always mandatory, many boaters choose not to get insurance. If you are hit by an uninsured or underinsured boater and you are injured, this type of coverage pays for medical treatment, lost wages, and other costs associated with the accident.

Should your boat sink or be seriously damaged, there is a chance that it could leak oil or fuel into the water. As the boat’s owner, you are required by law to have this cleaned up, which can be time consuming and expensive.

Your policy can provide coverage for many personal effects, including clothing, jewelry, cell phones, scuba/snorkeling and other sporting equipment, and fishing equipment. Limits vary by state, so check with us for what’s required in Mississippi. Personal effects coverage does not include jewelry, watches or furs.

This pays to repair or replace equipment that isn’t permanently attached to your boat or personal watercraft, but is designed for use primarily on a boat. This includes items like lifesaving equipment, water skis, anchors, oars, fire extinguishers, tarps, etc.

The Emergency Assistance Package provides coverage for towing, labor and delivery of gas, oil or loaned battery if the watercraft is disabled while on the water.

Tupelo Motorhome Insurance

Motorhome Insurance

At Insurance Managers, we understand that your motorhome is more than just a vehicle—it’s your home on the road. That’s why we offer comprehensive motorhome insurance designed to protect you wherever your travels take you. From collision and liability coverage to protection for your personal belongings inside, we tailor policies to fit your needs. And because great service doesn’t stop after the policy is issued, our team is always here to help—whether you’re filing a claim, updating coverage, or just have a question.

National Security Fire and Casualty

Protect your home on wheels with customized motorhome insurance. Click here to learn more about coverage options, claims support, and how Insurance Managers keeps you covered—wherever the road leads.

Agreed Value Coverage ensures that if your motorhome is totaled or stolen, you’ll receive the full insured amount you and your agent agreed upon—no depreciation, no surprises. At Insurance Managers, we help you lock in the true value of your motorhome so you can travel with peace of mind, knowing exactly what your investment is protected for.

Tupelo Business nsurance

Business Insurance

Insurance that protects your company, so you can get back to business.

Insurance Managers understands businesses in the community. You can find our offices in Tupelo, and our clients all around Mississippi. As an independent insurance agency in Tupelo, we take pride in reviewing your options with multiple insurance companies and comparing protection and prices to find the best value for your business.

We’re proud members of the Tupelo marketplace, and we’re committed to being an advocate for you and your business in times of need.

Our Commitment To Serve You

Insurance Managers knows that in Mississippi, there are as many unique insurance needs as we have neighbors who live here! Contact one of our helpful team members about your specific insurance needs.

Commercial & Business Insurance Products

- General Liability Insurance – Broad insurance coverage for your business and activities

- Commercial Property Insurance – Protect your business with insurance for your commercial property

- Business Auto Insurance – Cover your business with insurance for commercial vehicles

- Commercial Umbrella Insurance – Insurance coverage that helps protect your business from the rising costs of lawsuits

- Workers Compensation Insurance – Insurance coverage that helps you take care of your employees

- Bonds – Protect your assets with financial backups for promises made by others